Share This Article

During the October 28 meeting of the Sudbury Finance Committee, Sudbury’s Finance Director, Victor Garofalo, shared that free cash had been certified by the Division of Local Services, and it came in higher than most expected at nearly $7.3 million for fiscal year 2025.

According to the Division of Local Services (DLS):

“Free cash is a revenue source that results from the calculation, as of July 1, of a community’s remaining, unrestricted funds from its operations of the previous fiscal year based on the balance sheet as of June 30. It typically includes actual receipts in excess of revenue estimates and unspent amounts in departmental budget line items for the year just ending, plus unexpended free cash from the previous year. Free cash is offset by property tax receivables and certain deficits, and as a result, can be a negative number.”

In other words – if revenue comes in higher than expected, or a Town comes in under budget on a line item in a fiscal year, it produces free cash for the next fiscal year. Typically that is used to fund one-time expenses, capital needs, and other improvements in a Town. DLS does not recommend using free cash to fund the ongoing operating budget. And what few people know is that free cash is critical to sustaining a municipality’s credit rating.

The Division of Local Services recommends that municipalities generate free cash equivalent to 3 percent to 5 percent of their annual budgets:

The Technical Assistance Bureau (TAB) recommends that communities understand the role free cash plays in sustaining a strong credit rating and encourages them to adopt policies on its use. Under sound financial policies, a community strives to generate free cash in an amount equal to three to five percent of its annual budget.

DLS Free Cash Guidance

So where does Sudbury’s fiscal year 2025 free cash fit in the big picture? It’s 5.84 percent of the annual budget. A touch above the range recommended by DLS, but it’s important to understand how that came to be, and the Sudbury Finance Committee helped to highlight that in their October 28 meeting.

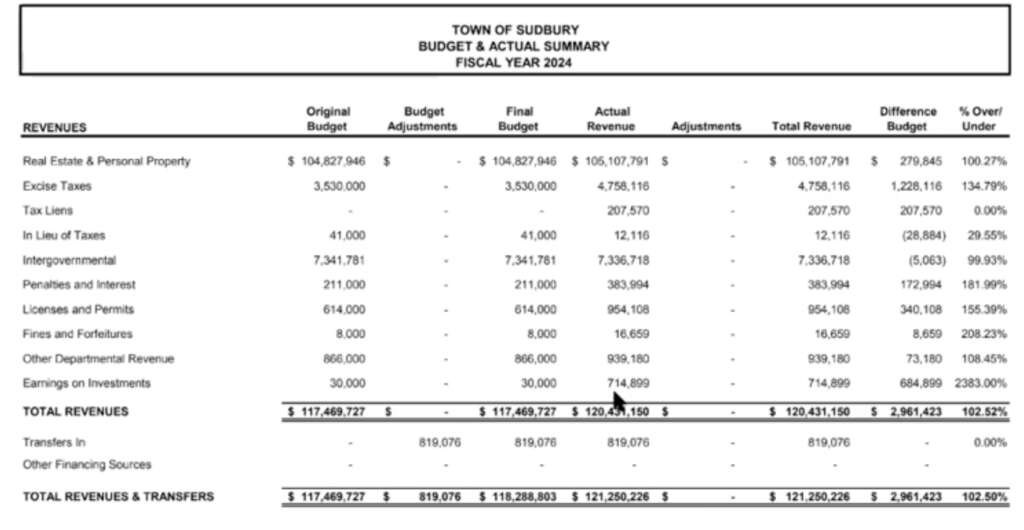

In fiscal year 2024, the town generated significantly more revenue from excise taxes and investment income than was forecasted. DLS advises towns to use conservative forecasting for revenue to avoid a shortfall in the middle of the fiscal year. Sudbury’s Finance Director explained to the Finance Committee that the average price of a new car had increased, and it appears that Sudbury residents purchased quite a few higher-end vehicles last year. The result is much stronger excise tax revenue; over $1.2M more than was forecasted. However, he added that the Town will likely increase the forecasted revenue moving forward based on this data.

Garofalo also pointed out that earnings on investments came in higher than forecasted. The Town generated over $700K on a forecast of $30,000.

On the expense side of the equation, vacancies in the Department of Public Works and Public Safety departments led to lower-than-budgeted expenditures. Vacancies lead to reversions from budgeted salaries and employee benefits according to Garofalo. (30:30)

Garofalo advised the committee that it would be unwise to build a budget with an assumption of cost savings from vacancies, because the Town would want to fill all those positions during the year. Unlike a private business, the Town can’t just change the budget mid-year. He went on to point out that most of the vacancies in the Sudbury Police Department have already been filled. That stood in stark contrast to weeks of hyperbolic commentary on social media. He also noted that the Fire Department faces greater recruiting challenges at the moment, and that he believes it’s because of a lack of interest in that career path.

Members of the Finance Committee did voice concerns at the level of free cash generated in a fiscal year that included an override for the schools. Further, they advocated for modifying forecasts for revenue based on the new data. Garofalo agreed with regard to excise taxes and earnings from investments, but was very clear that incorporating a vacancy factor into the budget was not recommended. He added that vacancies are a significant challenge throughout the municipal world right now, but the budget should assume that the goal is to fill every position.

Despite the readily-available guidance on free cash, chatter about free cash began to spread on social media and even in the Sudbury Public Schools School Committee on November 4. One school committee member suggested that Sudbury was taxing more than it spends, and joked that there will be jockeying by various groups to get some of the free cash.

It’s important to note that one driver of the strong free cash number is actually a municipal success story: investment income. Garofalo noted that he thinks he can deliver over $1 million in investment income in the upcoming year. That stretches taxpayer dollars further, and contributes to free cash without adding a tax burden.

Similarly, the increased revenue on excise taxes are driven by vehicle purchases according to Garofalo. There hasn’t been any change in the way the Town of Sudbury calculates excise tax. Shoppers just bought more expensive vehicles according to Garofalo. In fairness to the Town, it’s hard to predict how many residents will spring for the M performance package on their BMW X7, but apparently many residents did just that.

With revisions to the forecasts on excise tax and/or earnings from investments in the next fiscal year, the Town would likely fall well within the DLS guidance of free cash equivalent to 3 percent to 5 percent of the annual budget. It remains very difficult to predict trends in municipal staffing. Nonetheless, the Finance Committee is also tracking all of these matters quite closely as part of a new effort to evaluate revenue as thoroughly as they typically evaluate expenditures.

Given the nuances of municipal finance, and the unfortunate name of “free cash,” there’s certainly some risk that misinformation will continue to swirl around the topic. But the Division of Local Services is very clear on the matter: free cash is important for municipalities (particularly for funding capital projects), it’s critical to their credit rating, and conservative revenue projections are the key to bringing free cash in within the target range each year.