Share This Article

The Massachusetts Municipal Association (MMA) has issued a report titled “A Perfect Storm: Cities and Towns Face Historic Fiscal Pressures.” The report identifies key funding challenges facing Massachusetts municipalities, many of which have been escalating over the last 20-plus years.

The MMA highlights that:

“While state government spending has, when adjusted for inflation, increased by an average of 2.8% per year since 2010 to meet critical needs, constraints on local revenue sources, including Proposition 2½, have held Massachusetts city and town spending growth to just 0.6% per year.”

Adam Chapdelaine, the executive director of the MMA said “Municipalities have been frugal, and any cuts they’re forced to make are now cutting bone.”

Contrary to what many residents of the Commonwealth might assume, municipalities lag the national average for spending growth. “Annual spending growth for Massachusetts municipal governments lags behind the U.S. average for cities and towns, which is 1%.”

But does the trend hold in Sudbury and surrounding towns? And what happens if we run an analysis from the taxpayers perspective, rather than the municipality?

Inflation Nation?

The main challenge in evaluating average single family tax bills is that there are many factors that influence them. Valuations change, tax rates change, and if you don’t account for inflation, then you don’t really have an apples-to-apples comparison. In theory, residents of towns like Sudbury might be happy if they see massive growth in single-family valuations. In a real estate boom, a town can lower the tax rate and raise more money than the year prior. Though they’re still limited by Proposition 2 1/2. And all of that nuance exists before you layer in inflation.

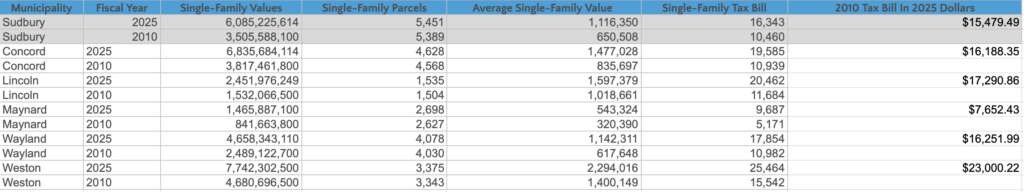

With all that in mind, Sudbury Weekly did a basic analysis of Sudbury and surrounding towns. We looked at the 2010 average single family tax bill, as reported by the Division of Local Services, then we used the inflation calculator provided by the U.S. Bureau of Labor and Statistics to convert the 2010 bill into 2025 dollars. What we found might surprise you.

In Fiscal Year 2010, Sudbury’s average single-family tax bill was $10,460. In 2025 dollars, that would be $15,479. The actual average tax bill in Fiscal Year 2025 was… $16,343. Meaning the tax bill has increased less than $1,000, when accounting for inflation, over the last 15 years. Yet even that modest increase can largely be accounted for by voter-approved overrides and debt exclusions for land acquisitions and major building projects. Voters approved the acquisition of Camp Sewataro for over $11M in 2019, then the construction of the new Fairbank Community Center for over $27M, as well as the acquisition Broadacres Farm for roughly $3.5M in debt and $2M from Community Preservation Act funds.

In comparison to surrounding towns in the analysis above, Sudbury’s single-family tax bill has grown the least above inflation over those years, with some towns increasing several thousand dollars above inflation.

Same Pressures, Different Impacts

At the same time as Sudbury has managed to limit inflation-adjusted single-family tax bills, single-family values have nearly doubled since 2010 in Sudbury, and all of the surrounding towns in this analysis for that matter.

The MMA reports describes municipalities aggressively seeking efficiencies to maintain services over these years. The good news is that those efficiencies have helped to drive significant growth in home values for property owners in Sudbury. The bad news is that the MMA is sounding an alarm that there isn’t much left to cut.

It’s simultaneously true that Sudbury and surrounding towns are well-off compared to the average town in Massachusetts, and Sudbury has one of the 20 highest single-family tax bills. But outperforming the average doesn’t take much: in Sudbury’s case, the single-family tax bill is more or less just keeping up with inflation.

While the report identifies key differences between urban, suburban, rural and gateway cities, the overall summary points to the same five issues:

The full report is available below.