Share This Article

Monday February 12 was Capital Night in Sudbury. That’s when the Select Board, Finance Committee and Capital Improvement Advisory Committee get together to review capital articles and the Town Manager’s Capital Budget. The committee members tend to ask clarifying questions, vet the proposed projects/purchases, and try to assemble a broader picture of how the Town is prioritizing capital projects.

Much of the discussion on Monday was procedural. Sudbury Town Manager Andy Sheehan presented the Town Manager’s Operating Capital Budget, and department heads presented other capital articles on the warrant for Annual Town Meeting. At a high level, the takeaway was that the town is continuing to implement recommendations from the Division of Local Services (DLS), as well as requirements from the Select Board’s updated Financial Policies.

There was some posturing and grandstanding by some of the panelists about the implementation of the capital policies toward the end of the meeting, but the Town Manager’s Capital Operating Budget itself reflects continued progress implementing both the Select Board policies and the DLS recommendations. Town Manager Sheehan noted that the Town charter, capital bylaw, and Select Board financial policies each provide different guidelines, so there might be more discussion in the future about how to get all of those aligned. Select Board member Roberts noted that even the financial policies leave room for the Town Manager to decide how to implement the processes prescribed by the policies, and signaled support for giving the Town Manager enough room to operate. (3:42:25)

The Town Manager’s Capital Budget is dropping very slightly year over year, and there’s a clear effort to do more debt-financed projects within the tax levy, rather than excluding the debt. That aligns with one of the major recommendations from the Division of Local Services in 2020, as Sudbury has often relied on debt exclusions for capital projects:

“The town’s pursuit of exempt debt as a primary capital funding mechanism is a risky strategy that works counter to desired objectives of levy stability and planning predictability. On the other hand, a formal policy that dictates the maintenance of a certain level of within-levy debt financing year after year would help provide a strong control for ensuring consistent capital investment.”

DLS REVIEW OF CAPITAL IMPROVEMENT PROGRAM

In-levy debt is precisely how Town Manager Sheehan hopes to fund the Atkinson Pool renovation. The warrant article currently estimates a need for $2.3 million to do the project and on Monday the stated intent was that it would be funded by in-levy debt if the warrant article is passed by Town Meeting in May. (3:04:01) If you want a peek into the future, you can review the 5-year capital plan here.

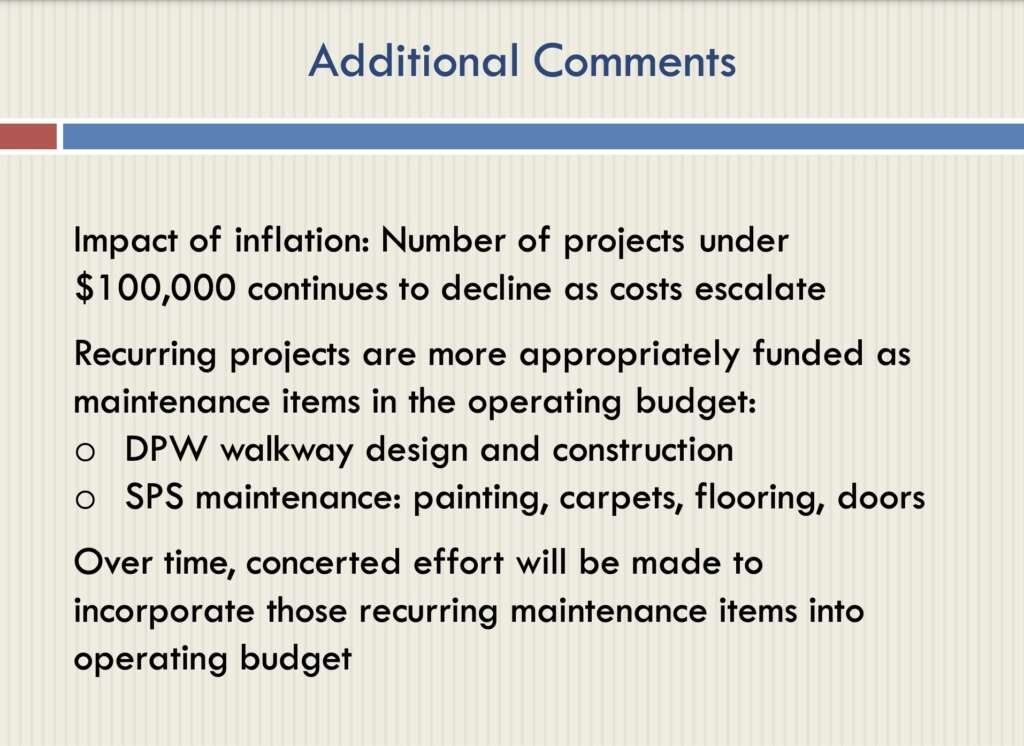

While the budget was sufficient to fund most of the capital requests, there were still a few that didn’t make the cut, or would need to seek other funding sources. The Town Manager’s Operating Capital Budget is still being tapped to fund recurring maintenance work that should be funded via operating budgets, and the hope is to address that in future budget cycles. Town Manager Sheehan also alerted the committees to the growing pressures created by cost escalation and inflation. (1:13:30)

The Town Manager’s Proposed Budget for FY25 was uploaded to the Town website recently. It tallies up to $124,379,269 and includes similar warnings:

“Department Heads identified myriad needs that would enhance service delivery for the community. Fixed costs continue to grow faster than available funds. As a result, very little remains for new initiatives or to address the numerous identified needs.”

Town Manager’s Proposed Budget for FY25

Longstanding requests for additional staff in the Police Department, Fire Department, Department of Public Works and Recreation Department were once again unable to be funded in the proposed budget.

For context and comparison, Concord’s FY24 proposed budget totaled $132,097,792 (page 4). So the Sudbury budget for FY25 is a good deal smaller than the Concord budget for FY24, and Concord has a similar population and similar total enrollment in Concord Public Schools when compared with Sudbury and Sudbury Public Schools. No two town budgets are exactly alike, and revenue sources can vary significantly from town to town, but the challenges municipalities are facing across the state appear to be much the same. For example, the Concord Finance Committee voiced similar concerns to Sudbury in their FY24 Annual Report:

“However, there are matters of concern as well, particularly as we look beyond FY24. Our projected levy capacity and Free Cash are estimated to be less in FY24 than they are in FY23 and are expected to decline further in FY25 and beyond. As discussed below, costs are projected to continue to rise for all the Town’s budgeting entities (CPS, CCRSD and the Town Departments) and certain revenue sources (in particular, emergency Covid relief funds) will no longer be available. Capital projects that have been deferred from past years will likely have to be undertaken in the next several years.”

Concord Finance Committee FY24 Annual Report

In light of some of these challenges, the Municipal Empowerment Act has been filed by Governor Healey. The act would allow municipalities to increase local taxes and fees such as the local option lodging tax, the local option meals tax, and a five percent surcharge on motor vehicle excise surcharge. Other provisions include changes to borrowing rules for school projects, changes to procurement rules, among others. That may be welcome news for municipal officials dealing with stretched budgets, but some taxpayers may see it differently at a time when housing costs are skyrocketing, a modest cut of steak costs an arm, and a double cheeseburger costs a leg.

Food prices aside, the Town administration has been consistent in identifying these budget pressures over the past year. Implementation of the DLS recommendations appears to be a major part of getting the budget into more sustainable shape. But that doesn’t happen overnight, and cost escalation continues to make matters more difficult while those policies and stabilization measures are implemented.