Share This Article

The Sudbury Community Preservation Committee (CPC) is tasked with administering Sudbury’s Community Preservation Act (CPA) program. Their work includes an obligation to “Study the needs, possibilities, and resources of the Town regarding community preservation.” On April 16, the committee held a public hearing to get input on potential future projects.

First, the Town of Sudbury’s Director of Planning and Community Development, Adam Burney, delivered a presentation on the Community Preservation Act program in Sudbury, including explanations of the surcharge and the application process. (3:00)

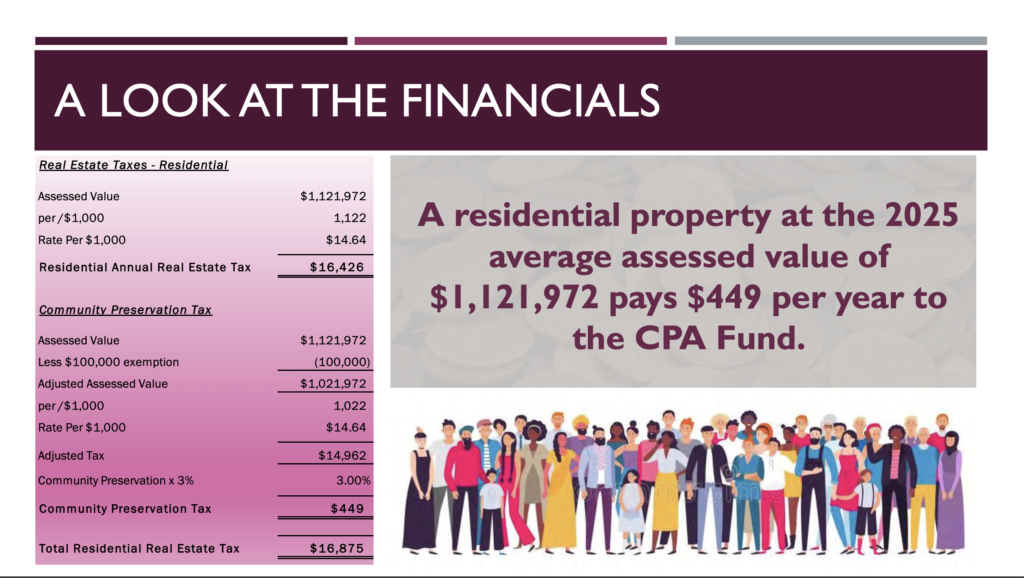

While some in the community are familiar with the fact that there’s a CPA surcharge on property taxes, fewer are likely to be familiar with the formula that determines their final bill. Burney explained the surcharge and added that the surcharge on an average assessed property in Sudbury is $449 per year.

The newest piece of data came when Burney presented the income and allocations since Sudbury joined the program in 2002. The surcharge has raised nearly $37 million locally, over $15 million in State matching funds, and interest on invested reserves has generated over $2 million in additional income.

Of the roughly $54 million in income sine 2002, Sudbury has allocated nearly $48 million to projects, just shy of 90 percent of all income, and just over 90 percent of surcharge and state match income. Burney noted that some communities choose to keep a reserve for major projects in the future, and others spend all of their CPA funds each year.

According to the presentation, 75 percent of Sudbury’s CPA funds have been allocated for open space and recreation projects.

The emphasis on open space and recreation projects is not surprising in a town that has historically put great value on open space, but Burney reported that CPA funds have helped preserve nearly 600 acres of open space since 2002. “We’ve preserved, in town, over 500 acres. Getting closer to 600. And you’ll notice that there are some really hefty preservations in there. 300 acres on Nobscot. While the town doesn’t own that, it did purchase the development rights through a conservation restriction, which is often a good way for CPA funds to be used because the Town doesn’t take ownership and responsibility for the property, but they do prevent future development, and the conservation restriction often includes access for the public.” (08:40)

The hearing concluded with a number of residents, committee and board members, and Town staff sharing their ideas for potential future projects that could be CPA-eligible. Examples included a Town Hall renovation, expanding the Featherland recreation complex onto the adjacent Broadacres Farm land that the Town acquired, and restoration of Henry Ford’s Carding Mill near the Wayside Inn.