Share This Article

Former elected officials from the Sudbury Public Schools (SPS) School Committee and the Goodnow Library Trustees have taken to local social media to spread falsehoods about how the Town of Sudbury handles Chapter 70 State aid for Sudbury Public Schools. Their allegation largely amounts to a claim that SPS doesn’t get all of its State aid from the Town of Sudbury each year, but there’s no basis offered for that claim.

The misinformation was thoroughly debunked by the Sudbury Finance Committee at a Special Town Meeting in 2023. During that Special Town Meeting SPS put forward an article to increase their operating budget in the middle of a fiscal year, using false claims that higher-than-estimated Chapter 70 aid would not go to the schools otherwise. (See the Finance Committee explanation at 2:26:50)

Town Meeting ultimately voted to increase the budget for SPS, and now the false claims have resurfaced after the current SPS School Committee voted in October to gather additional information from the administration on potentially using the maneuver again at this year’s Special Town Meeting.

While the current school committee did not ultimately put a warrant article forward to reuse the misleading Chapter 70 maneuver, the misinformation has been revived. One former elected official even created a video with graphics that made it appear as though Chapter 70 aid was two-thirds of the SPS budget. The Sudbury Finance Committee has previously reported that State aid accounts for approximately 10 percent of the SPS budget in a given year. The video also falsely claims that, when Chapter 70 aid comes in higher than estimated, the Town spends the money on non-education purposes.

Sudbury Weekly contacted Sudbury’s Assistant Town Manager and Finance Director, Victor Garofalo, to get the facts about how Chapter 70 funds are used in Sudbury. Here are his responses to our questions:

When Chapter 70 aid for SPS comes in higher than estimated in the preliminary budget does all of it still go to the schools?

GAROFALO: Yes. All Chapter 70 funds go directly to the schools, even if the final state allocation exceeds the preliminary estimate used during budget development. When the final Chapter 70 amount is confirmed, it’s reflected on the Town’s Tax Recap Sheet. As a result, the Town does not need to raise that additional amount through taxation, which increases unused levy capacity and helps manage the tax impact for residents.

Does the Town use SPS Chapter 70 aid for anything other than SPS?

GAROFALO: No. Chapter 70 funds are used solely to support the Sudbury Public Schools. They fund the schools’ operating budget, including insurance and benefits for school employees. None of these funds are diverted for non-school purposes.

In your experience, are there any common misconceptions about how Towns handle Chapter 70 funds that I haven’t asked about, and that you could clarify?

GAROFALO: A common misconception is that towns might redirect or “withhold” Chapter 70 funds from the schools. In reality, each district is required by the state to meet or exceed its Net School Spending (NSS) requirement, which combines both local and state contributions.

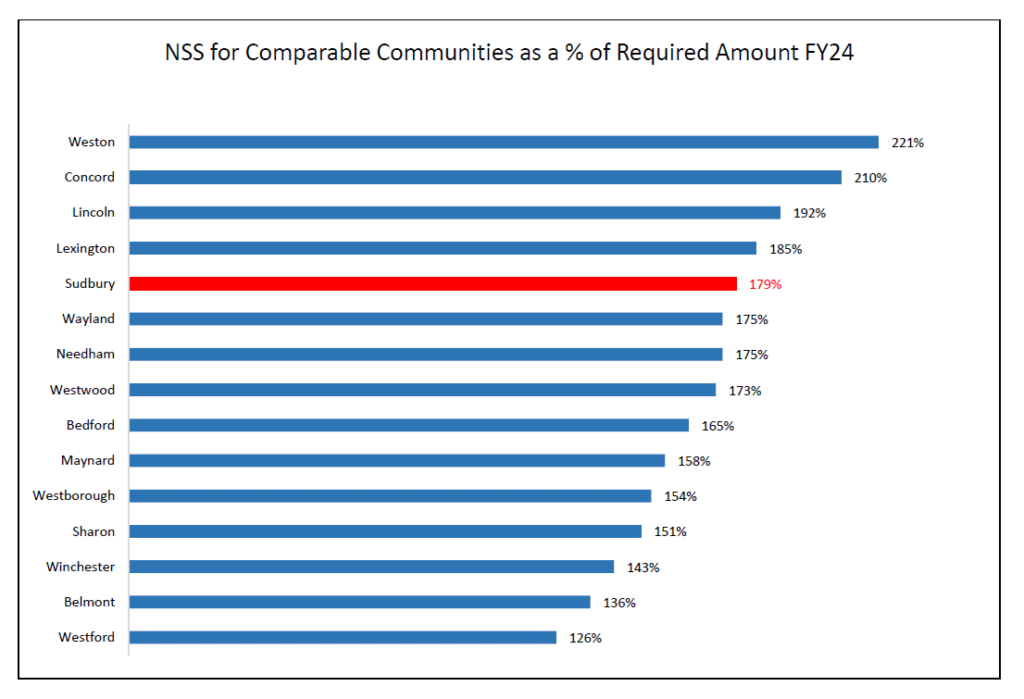

In Sudbury’s case, the Town consistently exceeds the state requirement, our total spending is approximately 179% of the required Net School Spending. Based on comparative data from 15 peer communities included in our Sudbury Budget and Financial Study, Sudbury ranks among the highest in terms of exceeding the minimum NSS requirement.

The concern would only arise if a community were close to or below the minimum required level of school spending, but that is not the case in Sudbury. You will see that since FY14, Sudbury Net School Spending Amount has gone from 135% to 179%.

A Simple Example

Sudbury Weekly published the following explanation in a prior article on Chapter 70 funds in Sudbury:

“One way to think about it is with small numbers. If you envision an SPS budget is 10 dollars for the year, 9 of those dollars come from local taxpayers and 1 of those dollars comes from Chapter 70 aid from the State. That tracks with the Finance Committee chair’s comments at the 2023 Special Town Meeting, in which he said there was roughly a 90/10 split between local taxpayers and state aid funding SPS.

Town Meeting votes in May to approve a 10 dollar budget for SPS, of which the Town will have to raise 9 dollars from taxpayers because they are expecting one dollar from the State. But in August, the State commits two dollars to SPS in the final State budget. That means SPS still has the 10 dollar budget they asked for at the Annual Town Meeting, but taxpayers only have to pay 8 dollars of it thanks to the good news from the State.

When SPS comes back mid-year and asks for that “unanticipated” extra dollar from the State to be added to their budget, it’s an overall budget increase to 11 dollars. Taxpayers go from being on the hook for 8 dollars in a 10 dollar budget to being on the hook for 9 dollars in an 11 dollar budget.”