Share This Article

Sudbury Town Manager Andy Sheehan is no stranger to big finance meetings. His first day as town manager fell on Sudbury’s “Capital Night” — an annual joint meeting of multiple boards and committees to review the capital budget ahead of Annual Town Meeting.

Sheehan gave his Financial Condition of the Town presentation on Tuesday, November 18. He has been warning of a potential override in Fiscal Years 2028 or 2029. As the Town begins the process of assembling the preliminary Fiscal Year 2027 (FY27) budget, Sheehan’s presentation sought to demonstrate the progress the Town has made towards a sustainable budget, while simultaneously setting the record straight in the face of mounting disinformation in Sudbury about free cash, other reserves, and State aid, to name a few.

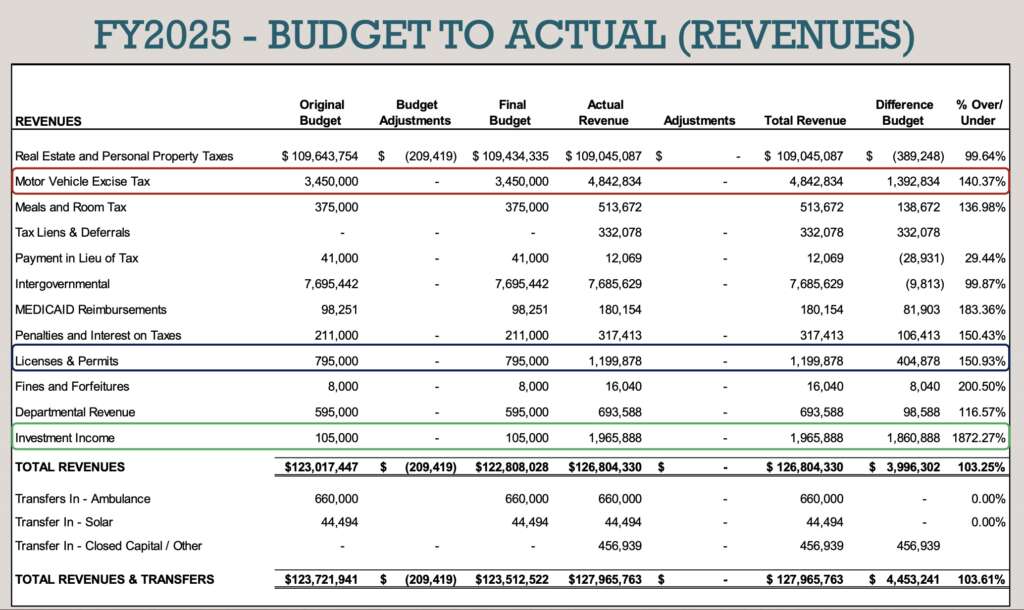

Sheehan came out of the gate with the FY25 Budget to Actual report showing that the Town brought in 103.6% of its target for revenue… with the amount over target largely explained by an increase in excise tax revenue, a huge spike in investment income, and a significant bump in licenses and permit fees.

On the expenditure side, Sheehan reported that the Town expended 98.7% of what was budgeted. Within two slides, Sheehan had demonstrated that the Town was neither “over taxing” or “over budgeting” — as has been alleged in certain online forums recently. The excess revenue came largely from investment income and excise taxes. Real estate taxes and personal property taxes were one of the few forms of revenue that came in below what was budgeted, albeit by less than half of a percent.

Later in the presentation, Sheehan offered a breakdown of free cash:

This graphic is important because it shows that nearly a third of the free cash was deliberately carried forward from a prior year. Sheehan presented the Town’s strong free cash position as a positive indicator of fiscal health, but also made it clear that Sudbury has one of the smallest free cash numbers relative to peer communities.

With the free cash disinformation thoroughly dispelled, Sheehan moved on to forecasts.

A Peek Into the Future

Sheehan noted that the future was uncertain, but the Town is anticipating some challenges maintaining level services in the coming years, with projected deficits in FY28 and FY29.

Sheehan went on to explain what an override would look like for residents, with the average impact to tax bills being just shy of $500 per year:

School Guidance

Sheehan debunked another piece of misinformation about school funding on Tuesday night. With claims swirling that Sudbury Public Schools (SPS) isn’t treated fairly relative to Lincoln-Sudbury Regional High School (LSRHS), Sheehan demonstrated that SPS is getting significantly larger budget growth in the upcoming fiscal year.

Sheehan gave 3.75% guidance to all three cost centers for FY27. The complexity of the comparison between the districts has to do with the nature of the school districts themselves. Since LSRHS is a regional school, they issue an assessment to member towns, and that includes employee benefits. SPS employee benefits are lumped together with Town employees outside of the SPS budget.

With debt for the construction of the high school coming off the books, the 3.75% for LSRHS looks like a 2.28% net increase in total dollars from one year to the next, but it’s a full 3.75% on their assessment. For SPS, the 3.75% guidance goes to their base budget, but once you add back in the SPS employee benefits, the net increase is 5.11%. That’s not even including over $7 million for two school roofs that will get a vote at Special Town Meeting in December, or any other capital project articles that come forward for SPS next May.

There was some confusion during the discussion regarding how Chapter 70 aid is handled. In prior years, and under a prior finance director, the Finance Committee was under the impression that LSRHS reduces its assessment to the Towns of Lincoln and Sudbury when Chapter 70 aid comes in higher than estimated in the budget. In turn, the Town would tax residents less in the back half of the year. That’s consistent with how the Town of Sudbury handles excess Chapter 70 aid that comes in for SPS.

During the meeting on November 18, Assistant Town Manager/Finance Director Victor Garofalo explained that he wasn’t sure exactly how LSRHS and the Town handled Chapter 70 previously, and added that during his time with the town LSRHS is handling Chapter 70 funds differently.

The LSRHS budget stays the same when Chapter 70 funds exceed estimates, but the excess revenue closes to “Excess and Deficiency” (E&D) — which is basically a free cash equivalent for regional schools. E&D has to be certified, and it’s governed by State law.

While the tax burden is therefore not reduced for taxpayers, the E&D stabilizes the finances of the district for the member towns, something that is uniquely necessary for regional schools. E&D functions almost like a reserve that can be tapped for emergencies or one-time expenses in the future. In the event E&D goes north of 5% of the budget, that triggers a reduction in the assessment of member towns according to a guide from The Massachusetts Association of School Business Officials. (Page 11)

Whether the excess Chapter 70 funds turn into lower taxes or go to E&D at the end of the fiscal year, the budgets for the two districts are the same as the budgets voted at Town Meeting. That’s what made the SPS maneuver so deceptive at Special Town Meeting in 2023 — it was really just a budget increase at the expense of taxpayers, but SPS characterized it as a transfer of Chapter 70 funds into their budget.

In summary:

- SPS is getting higher guidance than L-S when employee benefits are included in the comparison

- Both districts conservatively estimate Chapter 70 aid in their preliminary budgets

- Chapter 70 aid that comes in above the estimates does not go into the current fiscal year budget for either school district

- Both districts have a variety of methods available to them to amend their budgets mid-year in the event of an emergency

- Neither district has established a common practice of increasing their operating budget mid-year

- Both districts need to follow a legal process to tap into virtually all of the reserves available to them, even if they have different types of reserves

The Bottom Line

Town Manager Sheehan has consistently emphasized that collaboration is the key to navigating looming fiscal challenges. That may be put to the test in the next few weeks, as SPS is negotiating a teachers contract while simultaneously building their budget for FY27. Depending on how that process goes, the forecast for FY26 and beyond could change radically.

What’s clear following this year’s Financial Condition of the Town presentation is that Sudbury has stronger reserves than any time in recent memory, largely driven by the discipline Sheehan has consistently been calling for in his presentation. That makes it possible to maintain stability if the water gets choppy. Nonetheless, Sheehan’s recurring message of collaboration and working together across cost centers and departments felt urgent this time.

The full presentation is embedded below.