Share This Article

On Monday, October 6, the Sudbury Public Schools (SPS) School Committee voiced a desire to see more information about a potential article for a 2025 Special Town Meeting that would, according to their meeting packet, increase the amount of Chapter 70 funding in their budget for the current fiscal year. Chapter 70 funding is the primary form of state aid for public education.

The packet language indicated that this “increase” would pay for potential “contractual obligations.” The district is currently negotiating union contracts, including the contract for SPS teachers, but it is unclear from the packet and the discussion during the meeting if that is what they were referring to.

SPS used this same maneuver at a Special Town Meeting in 2023. While there was ample controversy, and the Town Meeting vote was close (115 in favor to 78 opposed), the article passed. The Select Board supported the article, but slapped the SPS administration on the wrist when Chair Janie Dretler read a statement of their position to the hall. The board chastised the SPS administration for failing to answer basic questions about why they suddenly needed the money mid-year, particularly since the town had already approved an override for SPS earlier in 2023.

The Finance Committee opposed the article, and went to great lengths before and during the Special Town Meeting to explain what was really happening with the money. As it turned out, the article was a mid-year tax increase, not a transfer of Chapter 70 state aid.

Jump to 2:18:00 below to see the motion introducing the article at the 2023 Special Town Meeting. Jump to 2:26:44 to see the Finance Committee explanation of what was really happening with the article.

When SPS described a Chapter 70 increase in 2023, there wasn’t a surplus of Chapter 70 funds sitting in an account that would be moved into the SPS budget. A vote of approval from Town Meeting meant SPS got the Town to collect more from residents in taxes than it otherwise would have.

To summarize some of the comments of Finance Committee Chair Mike Joachim and the general mechanics of what’s really happening with the money:

- All Chapter 70 money already goes to the schools each year.

- The final Chapter 70 state aid number comes in when the Governor signs the State budget. That’s usually several months after most towns set their budget for the fiscal year. As a result, towns estimate Chapter 70 aid from the State conservatively when they build their budgets.

- When the final number comes in from the State, it should be higher than the amount put into the budget for that fiscal year.

- When that happens, it simply means the Town can tax residents less that fiscal year to fund the budget that Town Meeting approved for SPS, because the Chapter 70 aid covers more of the SPS budget than previously anticipated.

- Your tax rate is actually adjusted in the middle of the fiscal year, when the Town has more information about the budget and State aid. This allows them to raise the right amount from property taxes to fund the budget through the end of the fiscal year. The whole process is governed by Massachusetts laws and agencies. You can read more here.

- When SPS described a Chapter 70 increase in 2023, there wasn’t a surplus of Chapter 70 funds sitting in an account that would be moved into the SPS budget. A vote of approval from Town Meeting meant SPS got the Town to collect more from residents in taxes than it otherwise would have.

A Simple Example

One way to think about it is with small numbers. If you envision an SPS budget is 10 dollars for the year, 9 of those dollars come from local taxpayers and 1 of those dollars comes from Chapter 70 aid from the State. That tracks with Joachim’s comments at the 2023 Special Town Meeting, in which he said there was roughly a 90/10 split between local taxpayers and state aid funding SPS.

Town Meeting votes in May to approve a 10 dollar budget for SPS, of which the Town will have to raise 9 dollars from taxpayers because they are expecting one dollar from the State. But in August, the State commits two dollars to SPS in the final State budget. That means SPS still has the 10 dollar budget they asked for at the Annual Town Meeting, but taxpayers only have to pay 8 dollars of it thanks to the good news from the State.

When SPS comes back mid-year and asks for that “unanticipated” extra dollar from the State to be added to their budget, it’s an overall budget increase to 11 dollars. Taxpayers go from being on the hook for 8 dollars in a 10 dollar budget to being on the hook for 9 dollars in an 11 dollar budget.

Residents and Town Meeting voters don’t have to be municipal finance experts to see what’s happening. The “motion” for the article at the 2023 Special Town Meeting said that it would “raise and appropriate” the funds. Raise means to tax residents, and appropriate means to spend it on the uses specified in the motion.

The motion claimed that the “raise” (increased taxes on taxpayers) was “offset” by the Chapter 70 funding, but that’s misleading. There was no offset for taxpayers. They went from paying $232,380 less than expected into the original SPS budget to paying that $232,380 to increase the original SPS budget by that amount.

As Joachim pointed out on the floor of the 2023 Special Town Meeting, Lincoln-Sudbury Regional High School reduces its assessment to the Towns of Sudbury and Lincoln when State aid comes in higher than budgeted. The State contribution reduces how much the district needs to lean on taxpayers to fund their budget for the year. If that sounds like an awfully good situation to be in as a Town, that’s because it is…

Net School Spending

One of the challenges with this Chapter 70 maneuver is that it can make sense in less affluent communities where the schools and the Town may be fighting over much more limited funding for essential services like education. But Sudbury and its peer districts are very different from most other municipalities.

The Massachusetts Department of Elementary and Secondary Education (DESE) “establishes minimum spending requirements for each school district and minimum requirements for each municipality’s share of school costs” through the Chapter 70 program. (Details here.) DESE also tracks compliance with “net school spending” requirements. Some districts are barely hitting their required spending in Massachusetts. But Sudbury is among the communities that is vastly exceeding its required spending.

In fact, Sudbury is in the top half of similarly affluent communities in this regard. Sudbury is spending nearly 200% of what it is required to spend on SPS by the DESE formula.

In theory, the Town Manager could give SPS average guidance for an annual budget increase and simply say “this guidance includes enough funds to cover any delta between estimated and actual Chapter 70 state aid” and the entire Chapter 70 discussion would be moot.

The year-over-year increase to the SPS budget that comes from taxpayers is orders of magnitude larger than the delta between estimated and actual Chapter 70 aid, so the idea that SPS isn’t getting money it is owed is a hard sell.

What’s actually happening is Sudbury taxpayers are stepping up to give the schools virtually all the money they say they need at Annual Town Meeting, and the final Chapter 70 aid takes a little bit of the edge off the property taxes later in the year so long as it comes in higher than it was budgeted.

New Fiscal Year, Old Discussion

Discussion about the Chapter 70 maneuver was limited during the Monday, October 6 meeting of the SPS School Committee, but the committee voted unanimously to ask for additional information on the potential article at a future meeting.

That sets up potentially tense conversations across various boards and committees. When SPS Superintendent Brad Crozier presented to Special Town Meeting in 2023, he called the budget increase “unique and specific” because the State had opted to make a “one-time” and “historic investment” in all school districts. That was the justification for bypassing the “standard annual budgeting process” used by the Town. Here’s the slide from his presentation:

Given the pushback to the justifications provided in 2023, it may be even more difficult to make a case for using the maneuver this fiscal year.

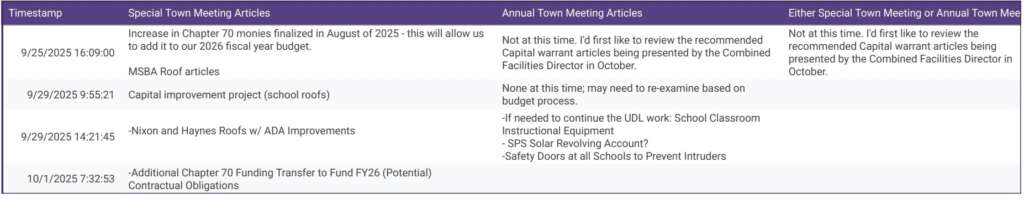

As of Monday’s meeting, the only justification provided did not come from Crozier, but came anonymously via survey responses about desired Town Meeting articles from the school committee members. One response simply said it would allow the district to add the Chapter 70 money to their existing budget but didn’t provide a reason. The other response referenced potential contractual obligations.

While the language around the maneuver can cause confusion, the emerging pattern may be a bigger problem for SPS. The budget increase for Fiscal Year 2024 came mere months after an override for SPS, and voters were told the increase was needed to cover unanticipated needs. Now in Fiscal Year 2026, the district could be asking for funds to cover, once again, needs that were not anticipated when the budget was presented to Town Meeting earlier in the calendar year.

The public won’t have to wait long to see what SPS will do next. Many expect the Special Town Meeting will be held in December, which means article submissions will be due within a matter of weeks. You can watch this week’s SPS discussion about warrant articles at 2:10:40 below.