Share This Article

During the Monday, September 29 meeting of the Sudbury Finance Committee, members were informed that the Town’s Fiscal Year 2026 (FY26) Free Cash amount had been certified.

The Massachusetts Department of Revenue’s Division of Local Services, which is responsible for certification, certified Sudbury’s free cash for FY26 at $9,395,877, according to documents released September 26.

Free cash represents the town’s unrestricted, undesignated fund balance available for appropriation at Town Meeting. The certified figure reflects adjustments for outstanding receivables, deficit balances, and deferred revenue, and will play a key role in shaping Sudbury’s FY27 budget and long-term financial planning.

In addition to the general fund free cash, the town’s enterprise funds also reported relatively healthy retained earnings balances:

- Transfer Station: $319,421

- Atkinson Pool: $552,073

- Field Maintenance: $72,862

Town officials have emphasized that maintaining strong free cash and reserves is essential for fiscal stability, bond ratings, and the ability to respond to unforeseen expenses.

The certification comes as Town staff and local boards prepare for FY27 budget deliberations, where decisions about the use of free cash, whether for one-time capital projects, stabilization funds, or other needs will be a point of discussion.

Free Cash In Context

The Division of Local Services provides guidance on free cash best practices. That guidance states:

“Under sound financial policies, a community strives to generate free cash in an amount equal to five to seven percent of its annual budget. This goal helps deter free cash from being depleted in any particular year, which enables the following year’s calculation to begin with a positive balance. To do this, the community would orchestrate conservative revenue projections and departmental appropriations to produce excess income and departmental turn backs.”

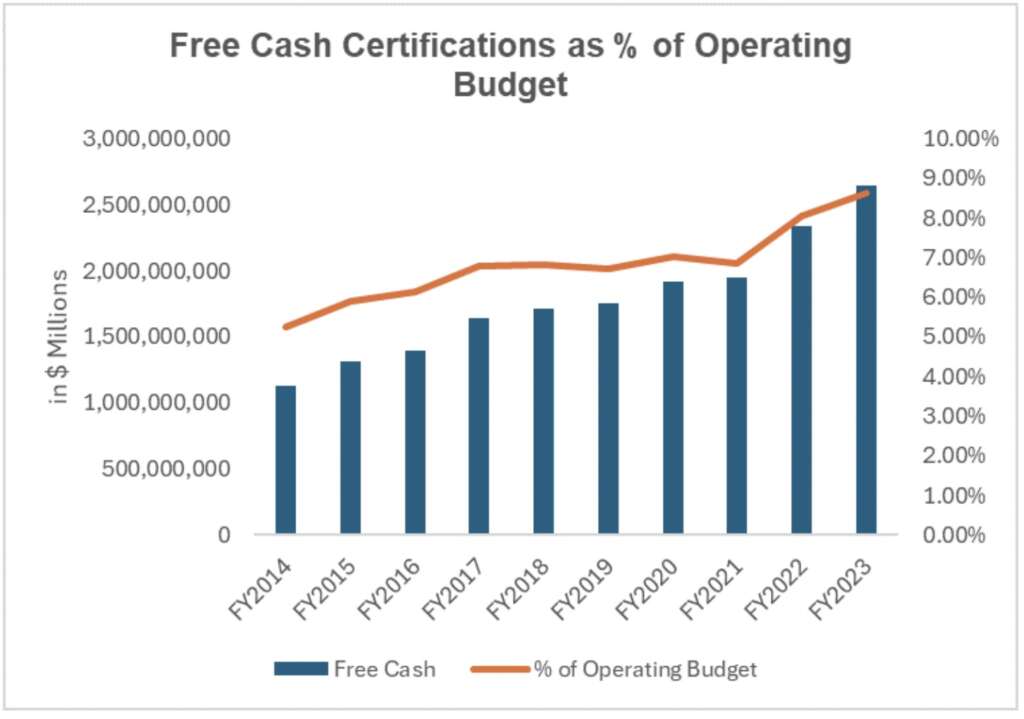

While Sudbury’s free cash has been growing in the last two fiscal years, it’s still hovering in, or slightly above, the range recommended by the Division of Local Services. However, Sudbury’s financial policies have not been updated to match the latest guidance from the Division of Local Services, so the policies still call for three percent to five percent of the annual budget in free cash.

That creates a bit of a pickle for those involved with the Town budgeting process. While FY26’s certified free cash is well above the Select Board’s financial policy target, that particular policy is not a “sound financial policy” based on the latest guidance from the Division of Local Services. While the guidance was updated recently, policies and outcomes vary widely from town to town across Massachusetts, with some towns generating more than 20 percent in free cash. The average in FY2025 was nearly 10% when calculated from the Division of Local Services data. That tracks with the trend they’ve been reporting for years.

On a related point, the FY26 free cash includes $2.8M that was carried forward from the FY25 free cash. That’s a significant carry-forward amount, though that was a deliberate decision the administration made last year as it focused on longer-term planning. A year ago, the Town was still in the process of developing a 15-year capital plan, and free cash has been a critical source of funding for capital needs in Sudbury.

Other drivers of the free cash included reversions in expenses, primarily due to vacancies in Town departments, very strong investment income, and higher-than-expected excise tax income.

During this week’s Finance Committee meeting, Victor Garofalo, Sudbury’s Assistant Town Manager and Finance Director, told the committee that the capital plan will be presented in the next month, and emphasized that capital needs were as high as $20M in a given year in the initial draft of the capital plan. In total, the capital needs expressed in the plan dwarf Sudbury’s free cash.

Further Reading

For more information on FY25 budget-to-actuals, read this.

For more information on FY25 Certified Free Cash, read this.

For general resources and information on municipal finance, read this.

For more information on municipal investments and reserves, read this.

For more financial comparisons to other municipalities, read this.