Share This Article

Sudbury closed the books on Fiscal Year 2025 (FY25) with stronger-than-expected revenues and careful spending, putting the town in solid financial shape as it moves into FY2026 and begins planning for FY2027.

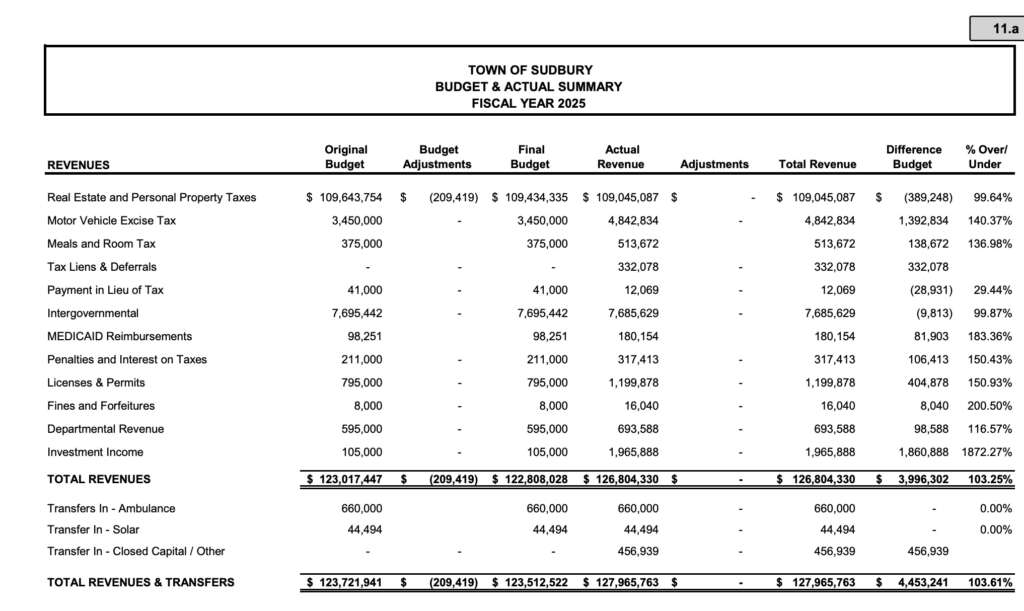

According to a memo (Page 74) and Select Board presentation from Finance Director and Assistant Town Manager, Victor Garofalo, total revenues reached $126.8 million, about $4 million above budget projections. Collections outperformed expectations across several areas, from motor vehicle excise taxes and building permits to meals taxes and investment income. On the spending side, town departments came in under budget, returning more than $1.6 million in unused funds.

“Fiscal Year 2025 ended on a positive note, with strong revenue growth and careful management of expenditures,” Garofalo wrote. “Together, these results position the Town in a strong financial footing as we enter FY2026 and begin planning for FY2027.”

Taxes: Strong Collections, Low Delinquencies

Sudbury collected 99.6% of property taxes billed for FY2025, with less than 1% still outstanding by year-end—a level Garofalo described as “typical and manageable.” Efforts to resolve older delinquent accounts continue, with several cases now in Land Court.

Local Receipts: Above Expectations

Local revenue sources provided some of the year’s biggest surprises:

- Motor vehicle excise taxes brought in $4.8 million, nearly $1.4 million above budget.

- Investment income surged to $2 million, reflecting higher interest rates.

- Meals tax collections climbed to $514,000, the highest in five years.

Garofalo cautioned, however, that some of these gains reflect temporary economic conditions—such as high car prices and elevated interest rates—that may not last. Going forward, Garofalo indicated that he would be increasing estimated motor vehicle excise taxes, but would still take a conservative approach.

Spending: Departments Underspend Budgets

On the expenditure side, vacancies in several town departments, lower-than-expected legal fees, and reduced school assessments all contributed to savings. Lincoln-Sudbury Regional High School, vocational schools, public safety, and public works each closed the year under budget. Garofalo told the Select Board that much of this was due to vacancies in various Town departments; but went on to inform the board that there is currently only one vacancy across all Town departments.

Free Cash Outlook

The town’s undesignated general fund balance rose from $9.7 million to $11.8 million. This improvement is expected to support a higher Free Cash certification from the state, strengthening Sudbury’s reserves heading into the next budget cycle. That being said, strong free cash performance last fiscal year ruffled some feathers. Read more about that here and here. To hear directly from a professional, you can read Sudbury Weekly’s interview on municipal reserves with Victor Garofalo here.

Looking Ahead: Override Averted?

While FY2025 was a strong year, Garofalo advised caution. Much of the revenue growth came from one-time sources such as tax settlements and large development projects. He recommended conservative budgeting for FY2026 and FY2027 to guard against swings in local receipts and investment income.

Town Manager Andy Sheehan told the Select Board that concerns about a potential override in FY27 eased slightly based on the results of FY25, but he was careful not to rule it out entirely at this stage. Sheehan has consistently advocated for budget discipline, long-term financial planning, and a collaborative approach to solving budget challenges since joining the Town of Sudbury. With a few budget cycles under his belt, and a Finance Director who has delivered significant upgrades to Sudbury’s budget reporting and analysis, Sheehan’s approach appears to be working.

Garofalo closed out his memo on a cautiously optimistic note. “Overall, the Town is well-positioned to maintain fiscal stability while preparing the FY2027 budget,” Garofalo wrote, “with the capacity to continue making strategic investments in core services and capital priorities.”