Share This Article

The Sudbury Select Board, at its Sept. 9 meeting, instructed Town Manager Andy Sheehan to review the Town’s current agreement with a private camp operator at Camp Sewataro and return to the board with options, information, and recommendations for how to proceed in the future.

In reviewing the current contract and the request-for-proposals (RFP) responses that preceded it, Sudbury Weekly found the Town of Sudbury’s evaluation of the price proposals was incomplete, inconsistent, and ultimately did not correlate to what has played out in the ensuing years.

The Town received three responses to the RFP for a camp operator in August 2019 after the May town meeting authorized purchase of the Sewataro property and the acquisition succeeded in an ensuing special election. The responses came from the MetroWest YMCA, K&E Camp Corporation, and Marcus Lewis Enterprises, Inc. All three proposals were for a summer-long day camp operation. K&E and Marcus Lewis proposed to replicate the Camp Sewataro programs and procedures. YMCA described continuing the same camp activities while adding new camp activities and other revenue-generating programs for the public throughout the year.

Though not ultimately chosen by the Select Board, the YMCA’s price proposal offered a significantly larger percentage share of the net revenue of a camp operation than the other bidders. YMCA also offered $30,000 more than the next highest bidder, K&E, in guaranteed annual payments to the Town.

K&E ultimately was awarded the contract, with then-Town Manager Melissa Murphy-Rodrigues citing the public access outlined in its technical proposal, and a lower level of risk to the Town in its price proposal.

Three Price Proposals

The price proposals are referenced in the RFP documents on the Town website, but the actual price proposals are not available on the Town website. The Town provided copies of the price proposals upon request from Sudbury Weekly. [All three are embedded at the bottom of this article.]

The three price proposals were similar to each other in form and structure, based on the RFP’s specific instructions. Each proposal specified a monthly fee that would be paid to the Town of Sudbury, as well as a proposed revenue sharing model.

Proposed Monthly Fee/Annual Total

| YMCA | K&E | Marcus Lewis |

| $12,500/$150,000 | $10,000/$120,000 | $0 |

Things get a bit more complicated with revenue sharing, because each price proposal offers a different model.

Here’s what’s in the proposals:

| YMCA | |

| $1.9M Gross Revenue | 20% of net revenue to Town |

| $2.2M Gross Revenue | 30% of net revenue to Town |

| $2.5M Gross Revenue | 40% of net revenue to Town |

| K&E | |

| First $500K Net Revenue | 20% to Town |

| Next $500K Net Revenue | 25% to Town |

| Net Revenue Over $1M | 33.33% to Town |

| Marcus Lewis | |

| Any net revenue | 33% to Town |

The key difference is how the percentage revenue share for the Town is tied to either gross or net revenue. K&E tied the three tiers to net revenue. YMCA tied the three tiers to gross revenue.

Under the YMCA model, as long as the gross revenue was $2.5M or higher, the Town would get the full 40% share even if net revenue was nominal.

Under K&E, the Town’s percent share of net revenue shrinks as profitability shrinks. And if profitability improves, the town is locked in at 20% for the first $500,000 and 25% for the next $500,000. To illustrate how that plays out, it’s easiest to compare to the Marcus Lewis proposal, which simply offered 33% share to the Town for all net revenue.

| K&E Corporation | Marcus Lewis | |

| $500,000 Net Revenue | $100,000 share to Town | $165,000 share to Town |

| $1,000,000 Net Revenue | $225,000 share to Town | $330,000 share to Town |

| $1,500,000 Net Revenue | $391,650 share to town | $495,000 share to Town |

| $2,000,000 Net Revenue | $558,300 share to Town | $660,000 share to Town |

In each of these net revenue scenarios, the Marcus Lewis revenue share proposal delivers about $100,000 more to the Town because the share percentage isn’t locked in at the lower level for the lower net revenue tiers. The blended percentage revenue share in the $2,000,000 line is 28% for K&E, because the percent share is lower for the first million in net revenue. The Marcus Lewis $660,000 share is a flat 33%.

The YMCA proposal functions the same as the Marcus Lewis proposal — one rate for all net revenue. Which rate to use merely depends on the gross revenue of the business. Basically, the bigger the overall camp business, the higher the revenue share percentage for the Town.

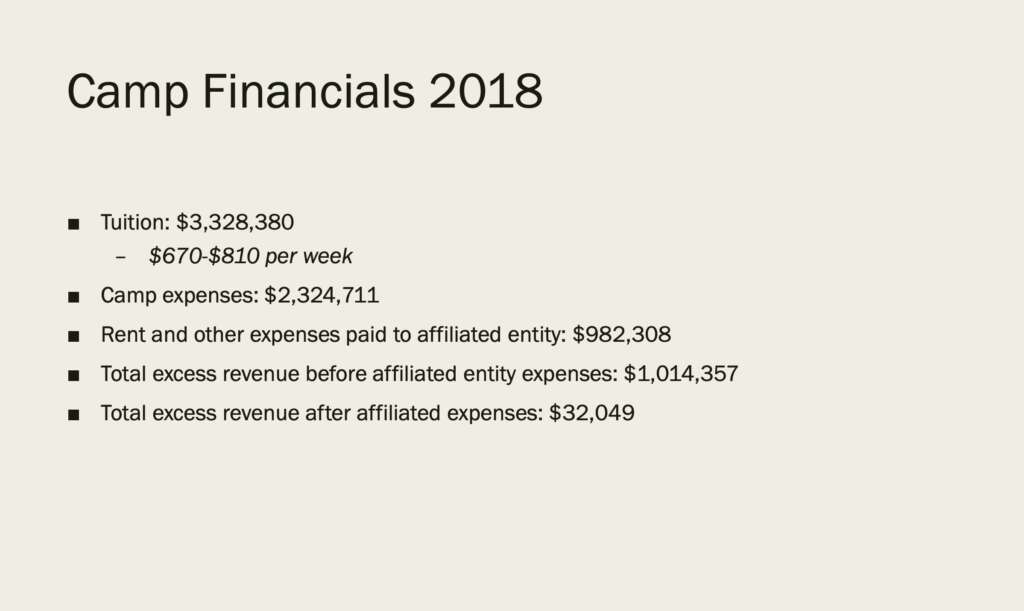

The Town had copies of Camp Sewataro’s prior financial statements and presented them to the public before the acquisition. In the years prior to the acquisition, Sewataro reported 600 daily campers, over $3 million in gross revenue from tuition, and “excess revenue” of over $1 million before paying $200,000 in property taxes and distributing the rest to an “affiliated entity.”

In order for the Town to get the full 40% revenue share from the YMCA proposal, YMCA would need to generate approximately 75% of the gross revenue that Camp Sewataro had already been producing.

If the roughly 33% profit margin of Camp Sewataro was preserved by a new operator, the YMCA offer would have been significantly more lucrative to the Town of Sudbury than the other two offers. Below a Sudbury Weekly analysis takes the same net revenue tiers, extrapolates out the gross revenue assuming 33% profit margins, and shows that in all but the worst-case scenario, the YMCA model would have produced significantly more revenue share for the Town of Sudbury, as well as an additional $90,000 in guaranteed payments over the first three years:

| Net Revenue | YMCA Gross Revenue at 33% Margins | YMCA Revenue Share (%) to Town of Sudbury | YMCA Revenue Share (Dollars) to Town of Sudbury |

| $500,000 Net Revenue | $1,500,000 | 0% | $0 |

| $1,000,000 Net Revenue | $3,000,000 | 40% | $400,000 |

| $1,500,000 Net Revenue | $4,500,000 | 40% | $600,000 |

| $2,000,000 Net Revenue | $6,000,000 | 40% | $800,000 |

There is some risk in the YMCA proposal at the low end. If the camp did less than $1.9 million in gross revenue, there would be no revenue share to the Town. But that would require the $3 million Camp Sewataro business to shrink by nearly 50% year-over-year. Whatever the downsides were, the considerable upsides of the YMCA revenue-sharing proposal did not come up in the August 20, 2019 meeting of the Sudbury Select Board.

An Incomplete Picture

That August 20, 2019 meeting of the Sudbury Select Board included a discussion of Town Manager Melissa Murphy-Rodrigues’ recommendation for the board to vote to authorize the Town to enter into negotiations with K&E. The board ultimately voted affirmatively, and unanimously, to do that. Sudbury Weekly reviewed the minutes of the meeting, and acquired a copy of the recording from SudburyTV to gather direct quotes from the discussion.

During discussion, Rodrigues summarized the rankings of the technical proposals. She noted that the rankings were very close, but stated that she felt the K&E technical proposal offered the “highest public access.”

When describing the price proposals, she noted that the Marcus Lewis proposal offered no guaranteed revenue and 33% of all net revenue. She then summarized the K&E and YMCA price proposals.

“The MetroWest YMCA’s proposal was $12,500 a month and 20% of the revenue at $1.9 million annual revenue.”

There was no mention of the 30% and 40% tiers in the YMCA proposal, and no mention of the monthly payment schedule.

Rodrigues then described the K&E proposal:

“Scott Brody’s proposal was $10,000 a month, paid in two annual installments of $60,000 each. And then 20% of the 500,000 dollars net revenue per year, 25% of the next 500,000 dollars in net revenue per year, and 33.33% of all net revenue in excess of $1,000,000 a year.” Brody was head of K&E.

Rodrigues concluded her evaluation: “So upon evaluating those three price proposals, it seemed to me that the Scott Brody [K&E] proposal held the least amount of risk and had the most chance of us…”

At that point Select Board member Janie Dretler interjected, “But the only guarantee of money is the base, which was Everwood [K&E] at $120,000 a year and the YMCA at $150,000 a year. Is that correct?” (Timestamp 12:30 below)

Rodrigues responded, “That’s correct, but based on my evaluation it seems like there was more of a chance of us getting the next percentage of the 20% with the Brody [K&E] proposal, which is why in the end I went with that one based on that and on the staff evaluations.” (Staff evaluations HERE.)

Select Board member Jennifer Roberts asked for an explanation why Rodrigues thought there was more risk with the YMCA proposal. Rodrigues described a “sliding scale pay rate” and that the YMCA 20% revenue share was at $1.9 million annual revenue, and “there’s a risk that we would never get to that $1.9 million annual revenue, while the Brody [K&E] proposal starts at a dollar.”

Dretler clarified that the YMCA $1.9 million was gross revenue, and Rodrigues confirmed it was, but none of the members picked up on the implications, and the discussion moved on.

Risky Business?

It remains unclear why Town Manager Rodrigues thought the YMCA was at risk of not achieving $1.9 million in gross revenue. Whoever won the bid was inheriting a camp that had established gross revenue higher than $3 million, decades of brand awareness, and a waiting list to get in.

The omission of the YMCA’s upper revenue-sharing tiers during the meeting appears to be accidental, as Rodrigues included that information in a detailed memo that was sent to the Select Board prior to the meeting. (Sudbury Weekly received a copy of the memo through a record request.)

While it’s difficult to forecast risk with so many unknowns in all three camp proposals, the Town of Sudbury now has several years of Camp Sewataro financial data that it can analyze.

Camp Sewataro generated over $4.3 million in gross revenue in 2024 — almost double the gross revenue required to get the maximum 40% share of net revenue from the YMCA proposal.

The annual financial reports calculate the total amount available for revenue sharing with the Town. This includes adjustments for various line items, but also includes sizable additions from forgiven Paycheck Protection Program (PPP) loans in 2021 and 2022. It’s also critical to note that the Select Board negotiated the terms of the contract for a contract extension in 2022, so the 2023 and 2024 numbers for K&E are based on an improved 25% revenue share for the first $1,000,000 in net revenue, and 33.33% for anything over $1,000,000.

Sudbury Weekly figured the results from the three bids based on the actual financial reports:

| Net Revenue Available For Share | K&E Revenue Share to Town | YMCA Share to Town | Marcus Lewis Share to Town | |

| 2021 | 1,341,854 | 338,940 | 536,741 | 442,811 |

| 2022 | 1,000,338 | 225,112 | 400,135 | 330,111 |

| 2023 | 371,826 | 92,956 | 148,730 | 122,702 |

| 2024 | 450,766 | 112,692 | 180,306 | 148,752 |

| TOTAL ’21-’24 | 3,164,784 | 769,700 | 1,265,912 | 1,044,376 |

Over the course of those four years, the YMCA model would have generated the most revenue for the Town, by a margin of half of a million dollars over K&E, even after the current camp operator increased the revenue share for 2023 and 2024. The Marcus Lewis price proposal would have generated the second most revenue share for the town, while the K&E model generated the least — though K&E did agree to a $200,000 guaranteed base payment with annual increases for the contract extension.

The YMCA model would have delivered 40% of net revenue in each of those years because tuition revenue alone exceeded $3 million each year — well above the $2.5 million gross revenue required to unlock the highest percent revenue share in its proposal for Sudbury.

The tuition revenue passed $4 million in 2024, demonstrating continued growth in gross revenue over the course of the current contract. With the benefit of hindsight, it would appear that none of the operators would have been at significant risk of falling below $1.9 million in gross revenue.

What’s the Forecast?

While it’s hard to forecast the risk of a joint venture between a municipality and a summer camp operator, it’s easier to forecast price proposals. In an analysis prepared for the Select Board before the contract was awarded, the Town opted not to forecast revenue share from the YMCA. The document noted “Metrowest YMCA did not provide enough information to project payments related to net revenue.”

The Town did create a forecast for the Marcus Lewis price proposal, though that proposal provided less information than the YMCA proposal. Again, the main differences between the YMCA proposal and the K&E proposal were that one tied the sliding-scale to net revenue and the other tied it to gross revenue, and the YMCA’s highest tier of revenue sharing was significantly higher than K&E’s.

For YMCA, the scale is tied to gross revenue, and the payout is tied to net revenue. Tying the percentage share to gross revenue insulates the Town from increases in operating costs that reduce total net revenue. For example, if a $200,000 capital project at Sewataro pushes net revenue down to $450,000 from $650,000, it wouldn’t change the percentage the YMCA would have paid, because that percentage is based on gross revenue. With K&E, a $200,000 capital project would push the Town to the bottom tier of 20% on the first $500,000, losing the 25% on the amount above $500,000. Both the percentage and the base for the Town get smaller.

None of the proposals provided a forecast of anticipated gross or net revenues and the RFP did not ask for or require that data to be submitted. K&E did provide a hypothetical example to explain how their revenue share would be calculated, but it was not a forecast.

Critically, the Town already had an example of gross and net revenue. The financials from the existing Camp Sewataro operator were presented to Annual Town Meeting in May 2019. The Town could have applied each price proposal to the actual financial performance of the existing camp business to get an apples-to-apples comparison based on real business performance.

That being said, the technical proposals varied in terms of what type of camp would be run on the property. K&E and Marcus Lewis made it clear that they intended to maintain the existing Camp Sewataro leadership team, programming and operations. Therefore, the risk assigned to the YMCA proposal appears to be largely based on the difficulty of accurately forecasting how the business will perform if the programming, staffing and operations on the property change.

The risk assigned to the Marcus Lewis proposal appears to be tied to the zero dollar monthly payment to the Town.

The Bottom Line

With several years of financial data now available, it’s clear that Sudbury would have captured significantly more revenue share from Camp Sewataro if one of the other revenue sharing models was in place. But the decision in 2019 had to be made without the benefit of hindsight. And there were many other considerations and unknowns at play. Town staff had to navigate all of that within a short window of time.

If the Town selected a different operator, would the Camp Sewataro experience still be the experience that generations of Sudbury residents remember? Would that impact business performance for better or worse? And would the public prefer or dislike the type of public access in the other proposals? It’s nearly impossible to predict.

For example, the YMCA proposal outlined additional programming options for the general public, including a seven-day per week Family Swim Club that also offered boating and swimming. It’s incredibly difficult for Town staff to determine if that’s more or less advantageous than public access that primarily allows residents to roam the property outside of camp hours. A swim program was eventually negotiated into a contract extension with the current camp operator. It doesn’t appear to have gained much traction in the last two years, but it does provide another data point for future decisions. It also demonstrates how seemingly desirable uses of the property may not pick up steam as anticipated.

Whether the topic is revenue models, continuity and preservation, or public access, one thing is evident: the upcoming evaluation of the current contract by the Town Manager is an opportunity for the Town to set clearer priorities and goals for the property. This time the decision makers will be able to evaluate options with robust financial data available, and without the intense time pressures of 2019.

***

[Personal information redacted from price proposals by Sudbury Weekly]